Category: Livestock

-

The Rising Star in Livestock: The Economic Potential of Bison

The bison industry is carving a unique niche within the agricultural market, emerging as a lucrative alternative to traditional livestock. Known for their robustness and the nutritional superiority of their meat, bison are becoming a focal point for producers looking to diversify their operations. This blog post delves into the import and export statistics of…

-

The Evolution of China’s Demand for Livestock Commodities

A Shift in Appetite: China’s Growing Hunger for Livestock In recent years, China’s demand for livestock commodities has undergone a significant transformation, reflecting broader economic, demographic, and cultural shifts. This burgeoning demand has sent ripples across global markets, reshaping trade flows and production patterns. This blog post delves into the changing landscape of China’s appetite…

-

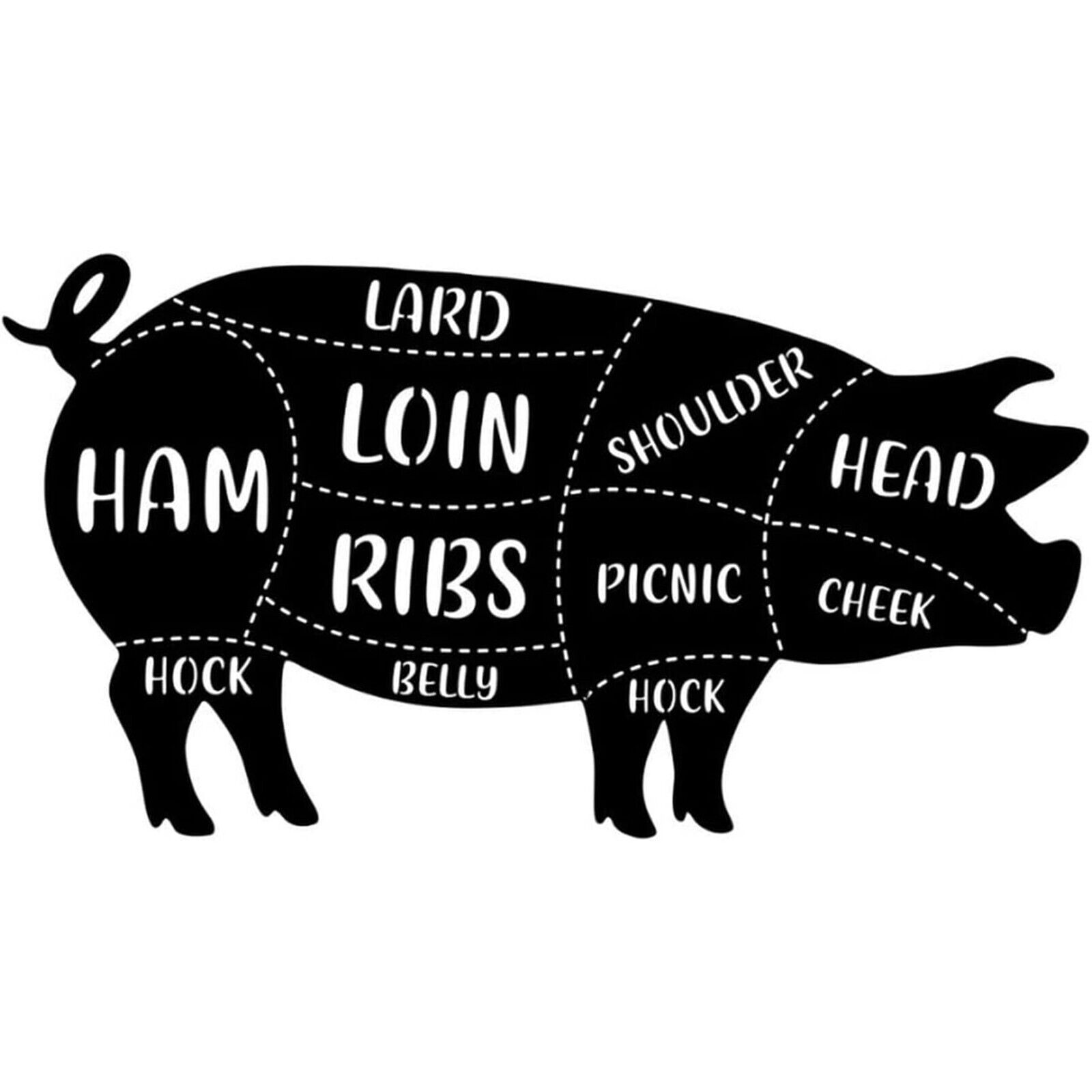

US Pork Belly Prices Skyrocket Amid Tightening Supplies

The Sizzling Surge in Pork Belly Prices In a significant development for commodity traders and the meat industry, US pork belly spot prices have seen a dramatic rise, as dwindling supplies intensify market dynamics. This post delves into the factors behind the soaring prices of pork bellies, a beloved staple for bacon enthusiasts, and what…

-

Navigating the Global Market: The Dynamics of Pork Belly Imports and Exports

A Deep Dive into the Pork Belly Trade In the intricate web of global trade, pork belly stands out as a fascinating commodity. This cut of pork, known for its rich flavor and versatility, has a significant presence in international markets. This blog post explores the nuances of pork belly imports and exports, shedding light…

-

Chicken Feet Craze: China’s Growing Demand and Global Trade Dynamics

Welcome to another insightful post on CommodityTrader.com. Today, we’re delving into an intriguing and perhaps surprising trend in the global food commodities market – the soaring demand for chicken feet in China. This niche product, often overlooked in many Western countries, has become a culinary delicacy and a significant import item in China. Let’s explore…

-

Livestock Commodity Trade: Market Facts and Figures

Welcome to another insightful blog post at Commodity Trader. Today, we delve into the world of livestock commodity trading, a sector that plays a pivotal role in the global agricultural market. Livestock commodities, including cattle, swine, and poultry, are not just essential for food production but also represent a significant portion of the world’s trade…