Author: Aaron

-

The Untapped Potential of Soft Commodities in West Africa

A Wealth of Agricultural Resources West Africa, a region rich in agricultural diversity, stands as a significant player in the global market for soft commodities. This region is home to a wide array of agricultural products, including cocoa, cotton, cashew nuts, maize, cassava, rice, sorghum, millet, and palm oil. In this blog post, we delve…

-

Mexico’s Ascendancy in Global LNG Exports: A New Era in Energy Trade

A Shift in Global LNG Dynamics In a significant shift in the global energy landscape, Mexico is projected to surpass Canada in liquefied natural gas (LNG) exports. This development marks a pivotal moment for Mexico, positioning it as a key player in the global energy market. This blog post explores the factors behind Mexico’s rising…

-

Weather Derivatives: An Innovative Hedging Tool in Commodity Trading

Harnessing Weather Uncertainties in the Financial Market In the dynamic world of commodity trading, weather derivatives have emerged as a critical tool for managing the financial risks associated with weather fluctuations. Unlike traditional financial instruments, these derivatives are specifically designed to hedge against the economic impact of weather variability. This blog post explores the nuances…

-

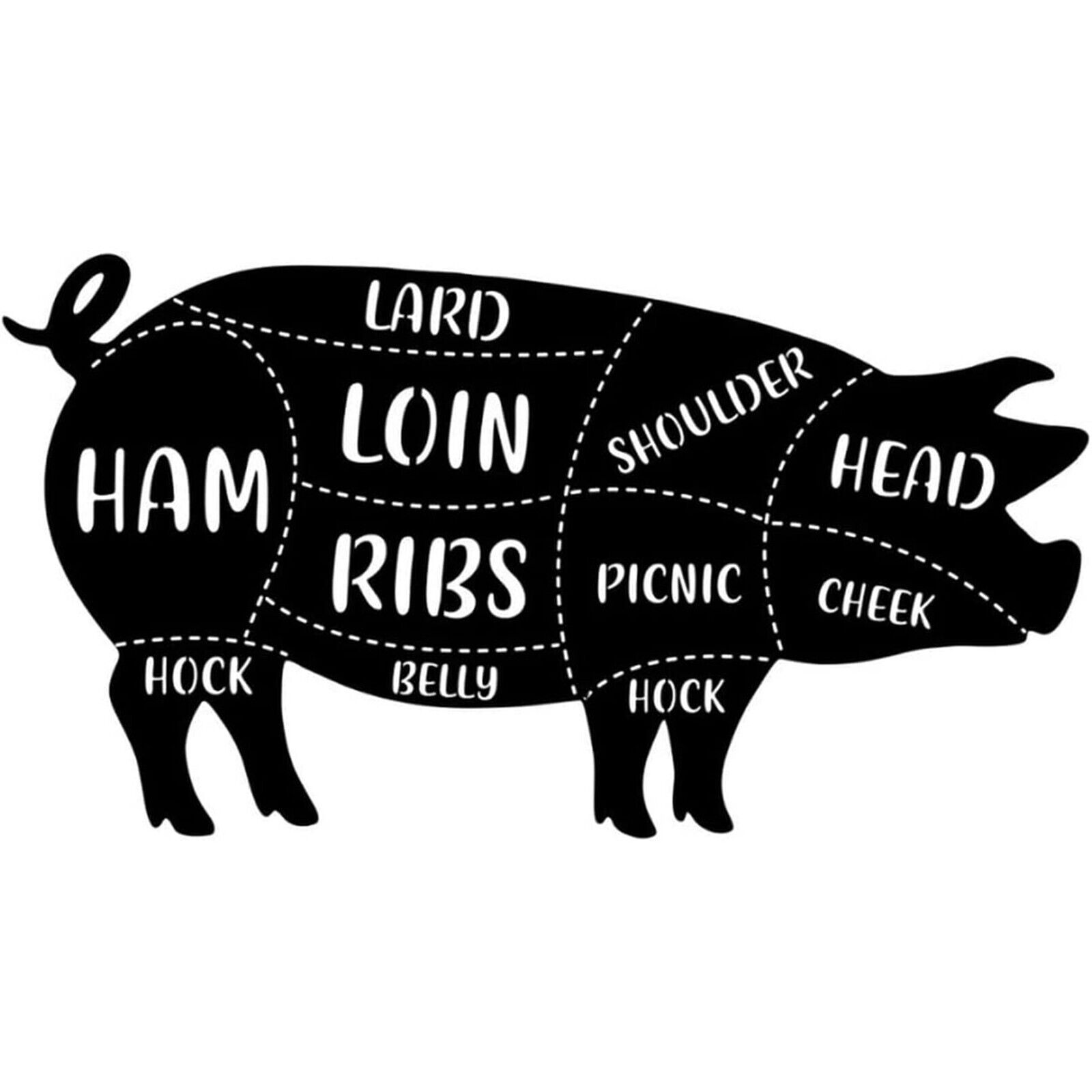

US Pork Belly Prices Skyrocket Amid Tightening Supplies

The Sizzling Surge in Pork Belly Prices In a significant development for commodity traders and the meat industry, US pork belly spot prices have seen a dramatic rise, as dwindling supplies intensify market dynamics. This post delves into the factors behind the soaring prices of pork bellies, a beloved staple for bacon enthusiasts, and what…

-

S&P Futures Nearing Record Highs: A Tech-Driven Market Rally

The Tech Sector Leads a Market Resurgence In the ever-evolving narrative of the stock market, a notable development has emerged: S&P Futures are approaching all-time highs, propelled largely by a tech sector meltup. This shift, marked by renewed optimism and significant upgrades in tech giants like Apple, is reshaping trader sentiment and market dynamics. Let’s…

-

Breakfast Commodities: Trends, Correlations, and Future Outlook

A Staple in Every Portfolio: Understanding Breakfast Commodities For commodity traders, breakfast commodities—such as coffee, orange juice, wheat (for bread and cereals), sugar, and cocoa (for chocolate spreads and hot cocoa)—present a unique market segment. This blog post delves into how these commodities correlate, their past performance, and projections for their future in the global…

-

Alberta’s Energy Exports: A Global Perspective on Trade and Markets

Harnessing Alberta Energy Wealth for Global Trade Alberta, Canada’s powerhouse of energy production, plays a pivotal role in the international energy market. Rich in natural resources, Alberta’s energy exports encompass a wide array of products, including crude oil, natural gas, and petrochemicals. In this blog post, we’ll explore the scale and scope of Alberta’s energy…

-

Navigating Agriculture Flows: Key Data Sources for Tracking Agricultural Cargoes

The Importance of Data in Agricultural Commodity Trading In the ever-evolving and complex world of agricultural commodity trading, staying informed about the latest market trends, cargo movements, and trade flows is crucial. For traders, analysts, and industry stakeholders, reliable data sources are invaluable for making informed decisions. In this blog post, we’ll explore some of…